The Different Types of Auto Insurance Coverage and How They Work

There are several types of auto insurance coverage, each designed to protect against specific risks and liabilities. The most basic form is liability coverage, which covers damages to other vehicles or property if the insured driver is at fault in an accident. Collision coverage, on the other hand, pays for damages to the insured’s vehicle, regardless of who is at fault. Comprehensive coverage protects against non-collision incidents such as theft, vandalism, or weather-related damages. Other options include personal injury protection (PIP) and uninsured/underinsured motorist coverage, which provide added layers of protection for medical expenses and accidents involving uninsured drivers.

Liability Coverage as the Foundation of Every Auto Insurance Policy

Liability coverage is often considered the foundation of any auto insurance policy because it provides protection for damages and injuries to others that occur due to the insured driver’s negligence. This coverage is generally split into two main components: bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses, lost wages, and legal fees of other parties injured in an accident for which the insured is responsible. Property damage liability, on the other hand, covers the cost of repairing or replacing another person’s property, such as their vehicle or a structure like a fence, that was damaged in the accident.

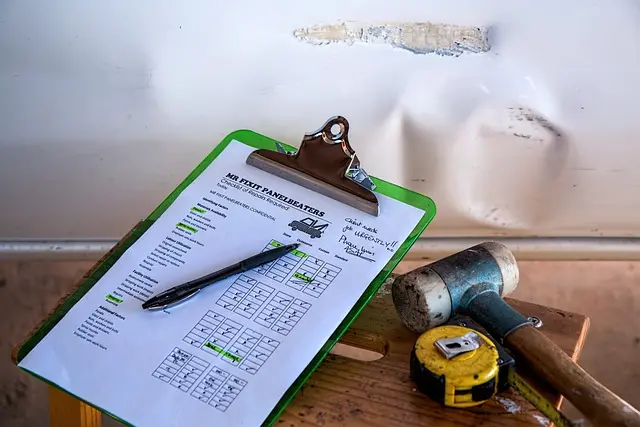

Collision Coverage and Its Role in Protecting Your Own Vehicle After an Accident

Collision coverage is essential for protecting your own vehicle after an accident, regardless of who was at fault. This type of insurance pays for the repair or replacement of your car if it’s damaged in a collision with another vehicle or an object, such as a tree or guardrail. While liability coverage only pays for the damages you cause to others, collision coverage ensures that your own vehicle is protected as well. Although collision coverage is not mandatory in most regions, it’s often required if you have a car loan or lease, as lenders want to protect their investment in your vehicle.

Comprehensive Coverage to Guard Against Non-Collision Incidents and Damages

Comprehensive coverage offers protection for your vehicle against damages caused by non-collision incidents. These incidents can include theft, vandalism, fire, floods, falling objects, or even animal-related accidents, such as hitting a deer. Unlike collision coverage, which only covers accidents involving another vehicle or object, comprehensive insurance protects your car from a wide variety of risks. This coverage is particularly valuable for drivers in areas prone to extreme weather conditions or high rates of vehicle theft. Although comprehensive coverage is typically optional, it is highly recommended for anyone looking to safeguard their vehicle from unexpected threats beyond traffic accidents.

Understanding Personal Injury Protection and Medical Payments Coverage

Personal Injury Protection (PIP), also known as no-fault insurance, is a type of auto insurance coverage that pays for medical expenses, lost wages, and other related costs for the policyholder and their passengers, regardless of who is at fault in an accident. PIP is mandatory in certain states and optional in others, but it can provide valuable financial protection in the event of an accident. Medical payments coverage, often called MedPay, is similar but typically only covers medical expenses. Both PIP and MedPay help ensure that medical bills are covered quickly, providing financial relief in the immediate aftermath of an accident.

Uninsured and Underinsured Motorist Coverage for Added Security on the Road

Despite legal requirements, not all drivers carry adequate auto insurance. Uninsured and underinsured motorist coverage is designed to protect you if you’re involved in an accident with a driver who has little or no insurance. Uninsured motorist coverage pays for your medical expenses and property damage if the at-fault driver doesn’t have insurance, while underinsured motorist coverage kicks in when the at-fault driver’s insurance is insufficient to cover the full extent of the damages. This type of coverage offers an extra layer of security and is especially important in regions with high rates of uninsured drivers or limited liability minimums.

Factors That Affect the Cost of Auto Insurance and How to Get the Best Rates

Several factors influence the cost of auto insurance, including your driving record, the type of vehicle you drive, your location, age, and even your credit score. Insurance companies assess these factors to determine the level of risk you present as a driver and adjust premiums accordingly. Drivers with a clean record and safer vehicles typically enjoy lower rates, while younger drivers or those with a history of accidents may face higher premiums. To get the best rates, it’s important to shop around, compare quotes from multiple insurers, and consider bundling your auto insurance with other policies like homeowners or renters insurance.

The Importance of Regularly Reviewing and Updating Your Auto Insurance Policy

Your auto insurance needs can change over time, so it’s essential to regularly review your policy to ensure you have the appropriate coverage for your situation. Life events such as buying a new car, moving to a different area, or adding a new driver to your household can impact your insurance requirements. Additionally, changes in your driving habits, such as commuting less or driving more for work, should be reflected in your coverage. By staying proactive and updating your policy as needed, you can avoid gaps in coverage and ensure that you’re adequately protected in the event of an accident.

Conclusion on the Value and Necessity of Comprehensive Auto Insurance Coverage

Auto insurance coverage is an indispensable tool for protecting yourself, your vehicle, and others on the road. From the essential liability coverage to more specialized options like collision and comprehensive insurance, these policies safeguard against the financial burden of accidents, theft, and damages. While no one anticipates being involved in a car accident, having the right auto insurance coverage in place ensures that you’re prepared for any situation that may arise. By understanding the different types of coverage and choosing a policy that fits your needs, you can drive with confidence, knowing that you’re financially protected against the unexpected.